White paper: Bringing B2B Commerce into the Modern Era: Lessons from B2C Read Now

White paper: The Critical Role for AI in Field Service LEARN MORE

Blog: Agentforce Activator | We’ll Help Bring Your Path to Life Read More

Mobile optimization, mass personalization, and social sharing fuel brand growth and stoke consumers’ emotional connection with the storied footwear and apparel company

In the hypercompetitive global sportswear and apparel industry, three brands—Adidas, Nike, and Under Armour—compete neck-and-neck for supremacy. The thriving market, estimated to reach $108 billion in global annual sales by 2025, is expanding due to increasing participation in fitness and sports activities. But along with performance innovations, fashion appeal is driving sales, especially with the rising popularity of athleisure and street style.

Adidas—which also owns the Reebok and TaylorMade brands—wanted to gain market share by transforming the way it engaged and activated its young, tech-savvy customers.

Adidas’ goal was 40% growth year-on-year, so ever evolving technology enablers had to be fused with behavioral-based design and feature functions, as well as innovative digital marketing strategies, to achieve their global goals. They chose to partner with Astound to develop a holistic, experience-driven commerce ecosystem that would expand the consumer base, enable cultural innovation by geography, boost brand loyalty, strengthen brand-customer relationships, and cement their reputation as a leader in street and performance wear.

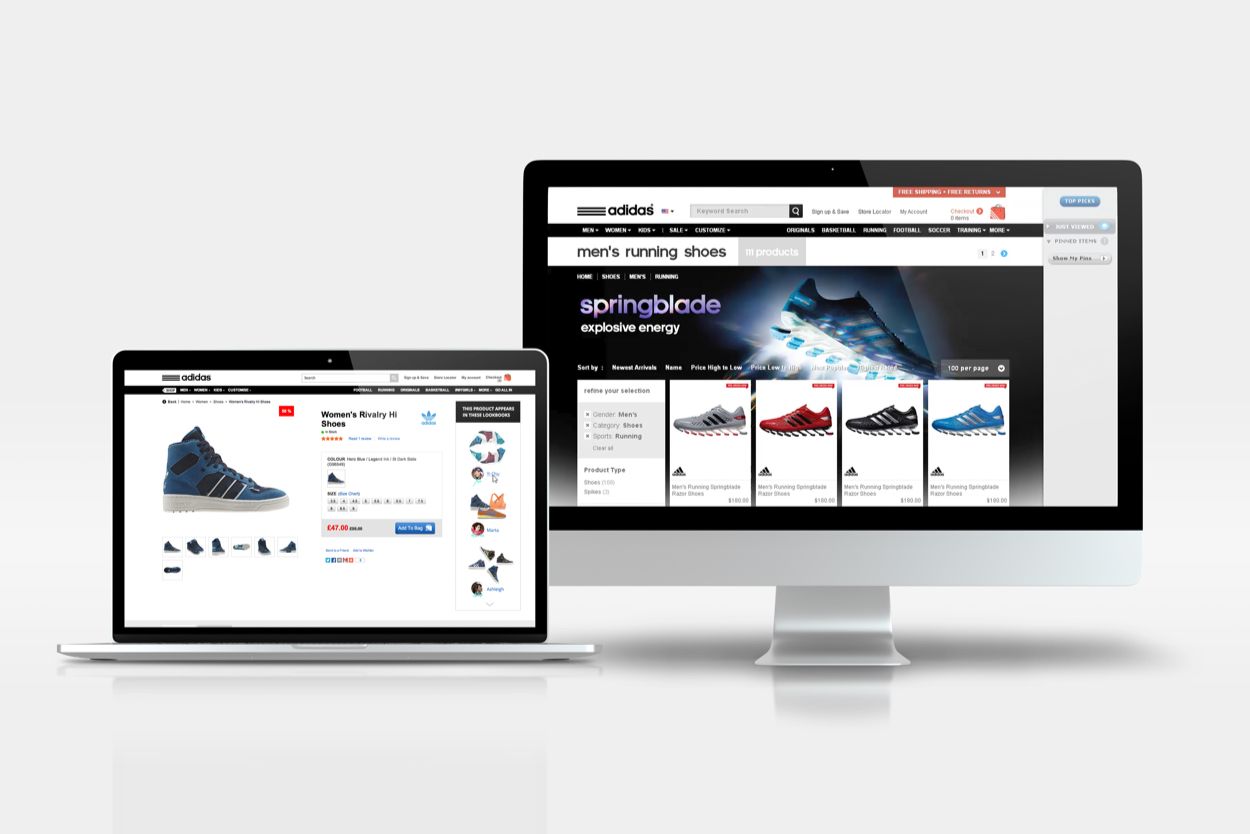

After analyzing the global digital footprints of Adidas and its competitors, as well as mapping the customer journeys through the sites, we realized several factors were thwarting Adidas’ success. Their sites were outdated and on multiple platforms, creating an inconsistent brand/customer experience across devices and regions. Their ecommerce platform wasn’t mobile-first, putting it out of touch with how their customers purchased items and acquired information. Content wasn’t shoppable, squandering a conversion opportunity, and few shoe and clothing customization opportunities existed—a glaring omission since Nike began offering such options back in 1999. Furthermore, user-generated content and social platform linkages weren’t actively encouraged, a missed chance to interact with the rabid online community of sneaker collectors; the lack of Instagram and social-sharing meant Adidas wasn’t capitalizing upon its 30+ years of sartorial favor for hip-hop and urban audiences (embodied by the direct line from Run-D.M.C.’s 1986 “My Adidas” through Kanye West’s 2016 “Facts” / Yeezy line of sneakers and apparel).

Re-envisioning Adidas as a digital-first brand equally fluent in mobile, retail, and social commerce, we designed a universal Demandware (now Salesforce Commerce Cloud) platform that could power customer engagement across every channel. Able to be customized for different markets, languages, and currencies, the platform provides a consistent CX. But it is responsive enough to offer unique consumer experiences and flexible enough to facilitate both local and global digital marketing campaigns. To streamline data transfer, we created a centralized catalogue and multichannel user profiles that allow customers to access their information—including their product wish lists—on any device as well as in-store. We developed miAdidas, a standalone web site for customizing Adidas shoes and apparel, and enabled social sharing of the designs. We began the overall project with the Adidas brand and then moved on to the company’s Reebok and TaylorMade divisions.

By identifying a unique digital commerce ecosystem for Adidas across all consumer touchpoints, we continue to help the sportswear company convert users, reach new audiences, and present a united brand identity. Opportunities for product customization and social sharing (the latter particularly popular in the fashion and streetwear communities) are driving sales and streams of user-generated content. And customers’ emotional connection to creating something unique—as well as voting, rating, and commenting on others’ looks and designs—is stoking both brand and channel loyalty. Data, segmented and rolled up by country and channel, is providing nuanced insights into consumers, product preferences, and the company’s supply chain. The info is also helping to optimize loyalty programs and lower customer-acquisition costs.